SOCR EduMaterials Activities ApplicationsActivities BlackScholesOptionPricing

From Socr

| Line 1: | Line 1: | ||

| - | == Black-Scholes | + | == [[SOCR_EduMaterials_ApplicationsActivities | SOCR Applications Activities]] - Black-Scholes Option Pricing Model (with Convergence of Binomial) == |

| - | + | ===Description=== | |

| + | You can access the Black-Scholes Option Pricing Model applet at [http://www.socr.ucla.edu/htmls/app/ the SOCR Applications Site], select ''Financial Applications'' --> ''BlackScholesOptionPricing''. | ||

| - | + | ===Black-Scholes option pricing formula=== | |

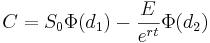

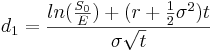

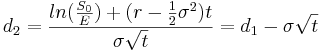

The value <math>C</math> of a European call option at time <math>t=0</math> is: | The value <math>C</math> of a European call option at time <math>t=0</math> is: | ||

| - | <math> | + | : <math> C=S_0 \Phi (d_1) - \frac{E}{e^{rt}} \Phi(d_2) </math> |

| - | C=S_0 \Phi (d_1) - \frac{E}{e^{rt}} \Phi(d_2) | + | : <math> d_1=\frac{ln(\frac{S_0}{E})+(r+\frac{1}{2} \sigma^2)t} {\sigma \sqrt{t}} |

</math> | </math> | ||

| - | + | : <math> d_2=\frac{ln(\frac{S_0}{E})+(r-\frac{1}{2} \sigma^2)t} {\sigma \sqrt{t}}=d_1-\sigma \sqrt{t} </math> | |

| - | <math> | + | |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | d_2=\frac{ln(\frac{S_0}{E})+(r-\frac{1}{2} \sigma^2)t} | + | |

| - | {\sigma \sqrt{t}}=d_1-\sigma \sqrt{t} | + | |

| - | </math> | + | |

| - | + | ||

Where, <br> | Where, <br> | ||

| - | <math>S_0</math> Price of the stock at time <math>t=0</math> <br> | + | : <math>S_0</math> Price of the stock at time <math>t=0</math> <br> |

| - | <math>E</math> Exercise price at expiration <br> | + | : <math>E</math> Exercise price at expiration <br> |

| - | <math>r</math> Continuously compounded risk-free interest <br> | + | : <math>r</math> Continuously compounded risk-free interest <br> |

| - | <math>\sigma</math> Annual standard deviation of the returns of the stock <br> | + | : <math>\sigma</math> Annual standard deviation of the returns of the stock <br> |

| - | <math>t</math> Time to expiration in years <br> | + | : <math>t</math> Time to expiration in years <br> |

| - | <math>\Phi(d_i)</math> Cumulative probability at <math>d_i</math> of the standard normal distribution <math>N(0,1)</math> <br> | + | : <math>\Phi(d_i)</math> Cumulative probability at <math>d_i</math> of the standard normal distribution <math>N(0,1)</math> <br> |

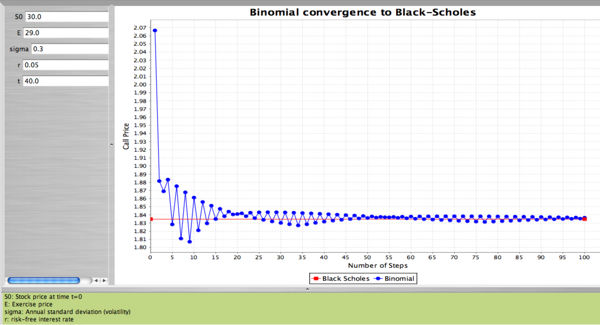

| - | + | ===Binomial convergence to Black-Scholes option pricing formula=== | |

| - | The binomial formula converges to the Black-Scholes formula when | + | The binomial formula converges to the Black-Scholes formula when the number of periods <math>n</math> is large. In the example below we value the call option using the binomial formula for different values of <math>n</math> and also using the Black-Scholes formula. We then plot the value of the call (from binomial) against the number of periods <math>n</math>. The value of the call using Black-Scholes remains the same regardless of <math>n</math>. The data used for this example are: |

| - | the number of periods <math>n</math> is large. In the example below we value the call option using the binomial formula for different values of <math>n</math> and also using the Black-Scholes formula. We then plot the value of the call (from binomial) against the number of periods <math>n</math>. The value of the | + | : <math>S_0=\$30</math>, <math>E=\$29 </math>, <math>R_f=0.05</math>, <math>\sigma=0.30 </math>, |

| - | call using Black-Scholes remains the same regardless of <math>n</math>. The data used for this example are: | + | |

| - | <math>S_0=\$30</math>, <math>E=\$29 </math>, <math>R_f=0.05</math>, <math>\sigma=0.30 </math>, | + | |

<math>\mbox{Days to expiration}=40</math>. <br> | <math>\mbox{Days to expiration}=40</math>. <br> | ||

| + | |||

* For the binomial option pricing calculations we divided the 40 days into intervals from 1 to 100 (by 1). | * For the binomial option pricing calculations we divided the 40 days into intervals from 1 to 100 (by 1). | ||

| - | * The snapshot below from the SOCR Black Scholes Option Pricing model applet shows the path of the stock. | + | * The snapshot below from the [http://www.socr.ucla.edu/htmls/app/ SOCR Black Scholes Option Pricing model applet] shows the path of the stock. |

<br> | <br> | ||

| Line 41: | Line 32: | ||

<center>[[Image: Christou_black_scholes_binomial.jpg|600px]]</center> | <center>[[Image: Christou_black_scholes_binomial.jpg|600px]]</center> | ||

| - | + | ===References=== | |

| - | + | The materials above was partially taken from: | |

| - | ''Modern Portfolio Theory'' by Edwin J. Elton, Martin J. Gruber, Stephen J. Brown, and William N. Goetzmann, Sixth Edition, Wiley, 2003 | + | * ''Modern Portfolio Theory'' by Edwin J. Elton, Martin J. Gruber, Stephen J. Brown, and William N. Goetzmann, Sixth Edition, Wiley, 2003. |

| - | ''Options, Futues, and Other Derivatives'' by John C. Hull, Sixth Edition, Pearson Prentice Hall, 2006. | + | * ''Options, Futues, and Other Derivatives'' by John C. Hull, Sixth Edition, Pearson Prentice Hall, 2006. |

| + | * [http://www.socr.ucla.edu/htmls/app/ SOCR Applications Site] | ||

| + | |||

| + | {{translate|pageName=http://wiki.stat.ucla.edu/socr/index.php?title=SOCR_EduMaterials_Activities_ApplicationsActivities_BlackScholesOptionPricing}} | ||

Revision as of 18:55, 3 August 2008

Contents |

SOCR Applications Activities - Black-Scholes Option Pricing Model (with Convergence of Binomial)

Description

You can access the Black-Scholes Option Pricing Model applet at the SOCR Applications Site, select Financial Applications --> BlackScholesOptionPricing.

Black-Scholes option pricing formula

The value C of a European call option at time t = 0 is:

Where,

- S0 Price of the stock at time t = 0

- E Exercise price at expiration

- r Continuously compounded risk-free interest

- σ Annual standard deviation of the returns of the stock

- t Time to expiration in years

- Φ(di) Cumulative probability at di of the standard normal distribution N(0,1)

Binomial convergence to Black-Scholes option pricing formula

The binomial formula converges to the Black-Scholes formula when the number of periods n is large. In the example below we value the call option using the binomial formula for different values of n and also using the Black-Scholes formula. We then plot the value of the call (from binomial) against the number of periods n. The value of the call using Black-Scholes remains the same regardless of n. The data used for this example are:

-

,

,  , Rf = 0.05, σ = 0.30,

, Rf = 0.05, σ = 0.30,

Days to expiration = 40.

- For the binomial option pricing calculations we divided the 40 days into intervals from 1 to 100 (by 1).

- The snapshot below from the SOCR Black Scholes Option Pricing model applet shows the path of the stock.

References

The materials above was partially taken from:

- Modern Portfolio Theory by Edwin J. Elton, Martin J. Gruber, Stephen J. Brown, and William N. Goetzmann, Sixth Edition, Wiley, 2003.

- Options, Futues, and Other Derivatives by John C. Hull, Sixth Edition, Pearson Prentice Hall, 2006.

- SOCR Applications Site

Translate this page: