SOCR EduMaterials Activities ApplicationsActivities Portfolio

From Socr

(Difference between revisions)

(→Portfolio theory) |

|||

| Line 1: | Line 1: | ||

| - | == Portfolio | + | == Portfolio Theory == |

An investor has a certain amount of dollars to invest into two stocks <math>IBM</math> and <math>TEXACO</math>. A portion of the available funds will be invested into | An investor has a certain amount of dollars to invest into two stocks <math>IBM</math> and <math>TEXACO</math>. A portion of the available funds will be invested into | ||

| Line 13: | Line 13: | ||

<math> | <math> | ||

| - | \mbox{Minimize} \ \ mbox{Var}(x_A R_A+x_BR_B) | + | \mbox{Minimize} \ \ mbox{Var}(x_A R_A+x_BR_B) |

| + | </math> | ||

| + | <math> | ||

\mbox{subject to} \ \ x_A+x_B=1 | \mbox{subject to} \ \ x_A+x_B=1 | ||

</math> | </math> | ||

Revision as of 04:41, 3 August 2008

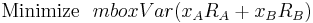

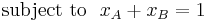

Portfolio Theory

An investor has a certain amount of dollars to invest into two stocks IBM and TEXACO. A portion of the available funds will be invested into IBM (denote this portion of the funds with xA and the remaining funds into TEXACO (denote it with xB) - so xA + xB = 1. The resulting portfolio will be xARA + xBRB, where RA is the monthly return of IBM and RB is the monthly return of TEXACO. The goal here is to find the most efficient portfolios given a certain amount of risk. Using market data from January 1980 until February 2001 we compute that E(RA) = 0.010, E(RB) = 0.013, Var(RA) = 0.0061, Var(RB) = 0.0046, and Cov(RA,RB) = 0.00062. We first want to minimize the variance of the portfolio. This will be: