SOCR EduMaterials Activities ApplicationsActivities Portfolio

From Socr

Portfolio Theory

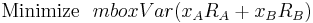

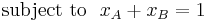

An investor has a certain amount of dollars to invest into two stocks IBM and TEXACO. A portion of the available funds will be invested into IBM (denote this portion of the funds with xA and the remaining funds into TEXACO (denote it with xB) - so xA + xB = 1. The resulting portfolio will be xARA + xBRB, where RA is the monthly return of IBM and RB is the monthly return of TEXACO. The goal here is to find the most efficient portfolios given a certain amount of risk. Using market data from January 1980 until February 2001 we compute that E(RA) = 0.010, E(RB) = 0.013, Var(RA) = 0.0061, Var(RB) = 0.0046, and Cov(RA,RB) = 0.00062. We first want to minimize the variance of the portfolio. This will be: